- BitMex’s Arthur Hayes has predicted that Bitcoin (BTC) could fall to $70k but may respond positively to macroeconomic measures to start the much-anticipated bull run from that position.

- For now, he believes that investors would continue to accumulate the dip but may “suffer through a long period of sideways”.

The woes of the broad crypto market continue as Bitcoin’s (BTC) Fear and Greed index reaches the “Extreme Fear” territory for the first time since FTX collapsed. On March 10, $649.07 million was reportedly wiped out in just 24 hours, dragging the Bitcoin price to $78k within the process. However, the asset has rebounded to $81k at press time but is still down by 0.32% in the last 24 hours.

Regardless, BitMex’s CEO Arthur Hayes has called for calmness as he believes that this level of correction is normal in the bull market.

Speaking to his X followers, Hayes pointed out that Bitcoin could likely bottom at $70k, representing a 36% fall from its all-time high price of $110k. Meanwhile, he expects some major stock assets like SPX and NDX to record some “free falls” before the major bull run.

Shedding more light on this, Hayes highlighted that macroeconomic factors could trigger the market’s explosive rebound. Firstly, he expects the People’s Republic Bank of China (PBOC), the European Central Bank (ECB), the Bank of Japan (BoJ) and the Federal Reserve to ease economic policies to stimulate growth.

In an economic sense, this involves lowering interest rates, injecting liquidity, quantitative easing, etc. Until then, Hayes believes that investors would continue to buy the dip. However, he suggests that risk-averse investors should wait for the central banks to “initiate these actions before they enter the market.”

Traders will try to buy the dip; if you are more risk averse, wait for the central banks to ease, then deploy more capital. You might not catch the bottom but you also won’t have to mentally suffer through a long period of sideways and potential unrealised losses.

In a previous article, we discussed Arthur Hayes’s analysis that estimated that Bitcoin could hit $250k this cycle. Fascinatingly, he predicted that the asset would first decline to between $70k and $75k before this massive move.

In another post, Hayes pointed out that Bitcoin could peak this month as the US considers extreme measures to avoid hitting the debt ceiling. As reviewed in our previous publication, he highlighted that this correction would disrupt the broad market and force altcoins to find support at their lowest.

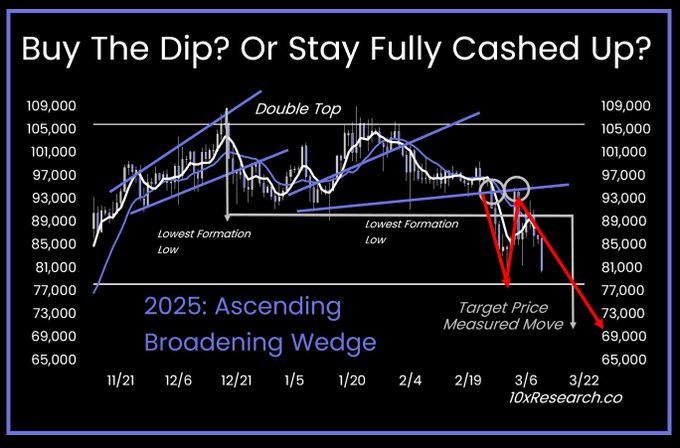

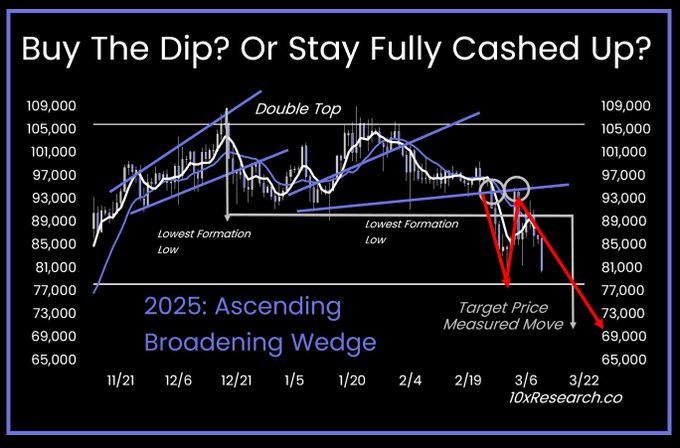

10X Research Analysis on Bitcoin

Joining the Bitcoin discussion, market research firm 10x Research has disclosed that the asset is exhibiting what they termed as “textbook correction”. According to them, about 70% of the recent liquidation came from investors who purchased in the last three months. Meanwhile, they believe that the market is perfectly following their February 2025 report which highlighted the collapse of a support structure after the asset fell below $95,000.

Reviewing their analysis, we found that the market situation became worse after the asset declined below $92,800, which was the average entry price for short-term holders. In a subsequent report titled “Bitcoin’s Next Big Buy Zone Revealed,” the research firm pointed out that a rebound attempt mostly follows a structural breakdown. In most cases, the price revisits the initial breakdown level to trap more long positions. In their March 3 report, 10X Research also recommended that traders close long positions.

This was the core thesis behind buying the sub-$80,000 dip while strategically closing long positions or re-entering shorts near the $92,800 rebound level (here). Fueled by the “Trump Pump”—driven more by speculative hype than solid fundamentals—Bitcoin surged to $94,000.

Prior to this, the research firm had predicted that Bitcoin would hit $122k by February. As noted in our earlier post, the analysts highlighted that the asset’s key milestones include maintaining the $101k support level and surpassing its $106k level.

Recommended for you: